FINANCIAL COACHING

Holistic Approach:

Think of us as your one-stop-shop for financial know-how, resources, and help whenever you need it. We’re all about giving you the full picture when it comes to your money.

Tailored for You:

Everyone’s different, right? That’s why we offer advice and strategies that fit just your situation and goals. No one-size-fits-all here.

Knowledge is Power:

We’re big on teaching you the ins and outs of finances. The more you know, the better choices you can make, and the more control you’ll have over your money.

Building for Tomorrow:

It’s not just about getting by today; it’s about setting up a legacy of wealth that lasts for generations to come. Let’s make sure your future family’s set up for success.

FINANCIAL COACHING SERVICES

Personalized, sessions each month focusing on specific financial goals, strategies, and progress tracking.

Meet with a coach on a specific topic of your choice.

Discuss the basics of personal financial management and design your personal financial roadmap for financial welleness.

Designed for individuals that experience a life event that is beneficial or detrimental to their finances and need direction.

Personalized assistance in understanding and choosing the best options from employer-provided benefits packages, including health insurance, retirement plans, and other perks.

Comprehensive analysis of income and expenditures to create an effective budget, optimize savings, and improve overall cash flow management.

Evaluation of current insurance policies (life, health, property, etc.) to ensure adequate coverage and advice on potential adjustments or additional coverage needs.

FINANCIAL LITERACY

Customized Learning:

From a single presentation to a full-fledged curriculum, we collaborate with you to craft financial literacy programs tailored to your needs. Our approach ensures that the content is both relevant and effective.

Engaging and Timely Content:

Our materials are designed to captivate and inform. We focus on presenting topics that are not only current but also come with examples that resonate with real-life scenarios.

Cultural Relevance:

Recognizing the importance of cultural context, we tailor our content to speak effectively to diverse audiences. Our approach is to make the material relatable through cultural understanding and sensitivity.

Enjoyable Education:

We believe financial literacy can be both informative and enjoyable. Our sessions are designed to be engaging, ensuring a learning experience that is both educational and fun.

FINANCIAL LITERACY SERVICES

Financial Literacy Consultant

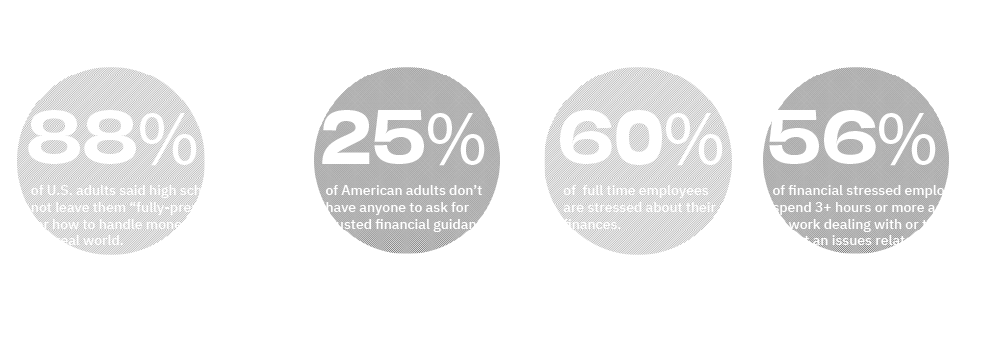

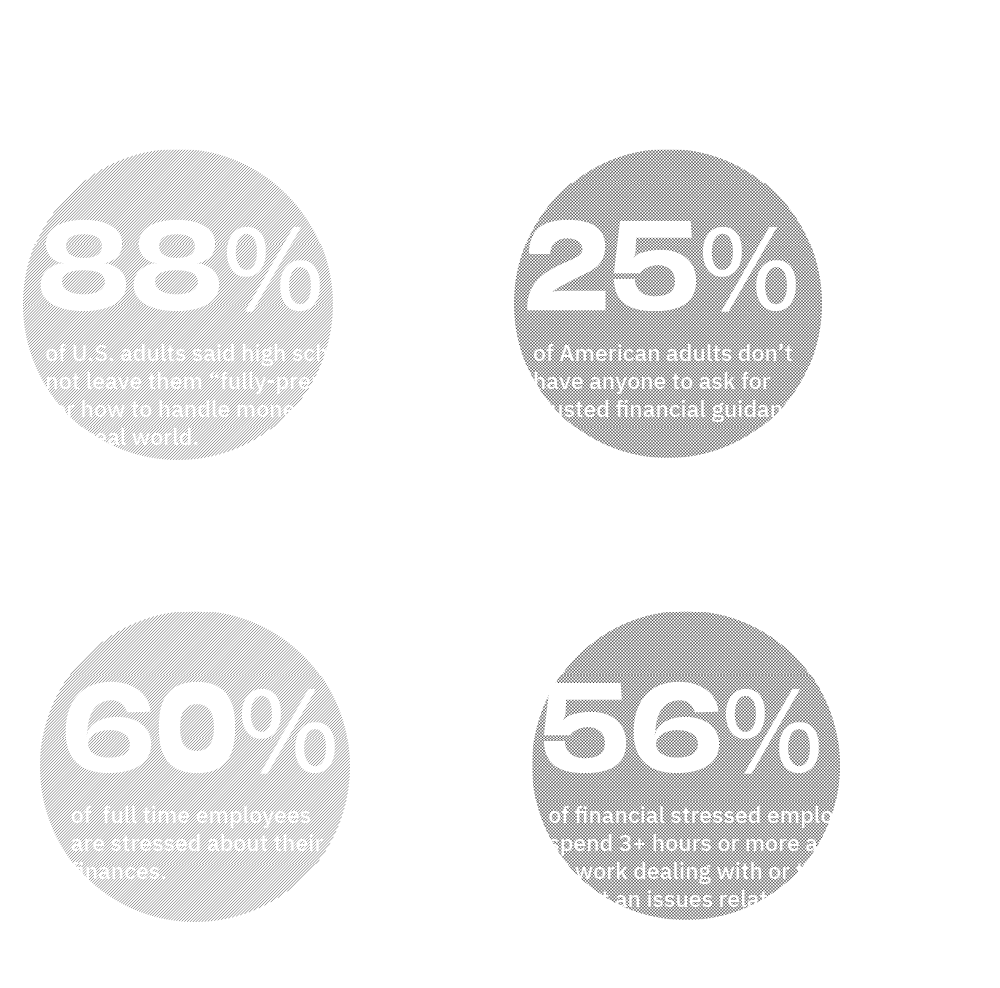

Financial education programs often fall short in diversity, and frequently provide information that isn’t practically applicable, leading to disengagement and poor participation. Greenwood and Archer designs strategies and programs that actively engage communities, resonate with diverse audiences, and employ exciting, motivational teaching methods.

Corporate Wellness Programming

Corporate wellness programs have consistently demonstrated their ability to boost employee productivity and reduce absenteeism. Greenwood and Archer can create interactive seminars and workshops tailored to address the immediate money management concerns your employees face. Our workshops are available in-person and virtually and can be customized in terms of topic and duration to suit your organization’s needs. Sample workshops include:

Effective Goal Setting Set and achieve your financial dreams. This seminar guides you through setting realistic financial goals and creating actionable steps to turn those goals into reality.

Laying Your Financial Foundation Dive into the essentials of building a strong budget. We’ll guide you through the basics and beyond, ensuring your budget is a robust foundation for your financial plans.

Preparing for the Unexpected Learn the importance of emergency and short-term savings. This workshop teaches you how to build and maintain a financial safety net for life’s unexpected turns.

Strategies for Financial Freedom Tackle and eliminate your debt head-on. This empowering session provides tools and tactics to manage, reduce, and ultimately destroy debt, paving the way to financial freedom. Guarding Your Family’s Finances Secure your family’s financial well-being. This workshop focuses on insurance, estate planning, and other key strategies to protect your family’s financial future.

Building and Boosting Your Score Master the art of credit building. Understand the ins and outs of credit scores, how to improve yours, and why it matters in your financial journey.

Shielding Yourself from Fraud Don’t fall prey to identity theft. Learn proactive measures to protect your personal information and what steps to take if you ever become a victim of identity fraud.

Contact us and we will work with you to customize a workshop that fulfills your needs.